Column Tip

Need a simple column look without the hassle of column formatting? Create a table with the number of columns and rows you need, hide the lines of the table, and you have a column look without the hassles of Word’s column feature.

Click on Table on the Insert Ribbon (Word 2007).

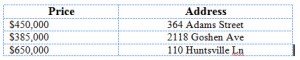

- Highlight the number of columns and rows you want. Hold your mouse button down and drag if you need more columns or rows than showing on the grid. The illustration below will give me three columns and three rows.

- Type your content and size the columns and rows as needed.

- Hide table lines: Select the table. Make sure the Table Tools Design Ribbon comes in to view. If it doesn’t, try double-clicking on the table selector.

- Select No Borders from the Borders drop-down box.

Note: the table may appear on screen to have light blue dotted lines still – but they will not print.

Insert a Word table.

Like knowing the shortcuts? Our Microsoft Word Shortcuts “Cheat Sheet” is now available. Click here for more information.

Tags:

Columns,

Table,

Word

If you would like to figure out what a loan payment will be, use Excel’s PMT function.

=PMT(rate,nper,pv,fv,type)

Rate = Interest rate for the loan. Because the interest rate is per annum, you must divide it by 12.

Nper=Number of payments, expressed in years x 12.

Pv=Present Value, otherwise known as the principal or loan amount

Fv=future value, or a cash balance you want to attain after the last payment is made. If fv is omitted, it is assumed to be 0 (zero), that is, the future value of a loan is 0.

Type = (Optional) When payments are due. (Zero or omitted=end of period, 1 is at beginning of period).

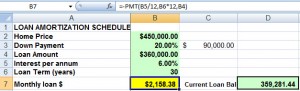

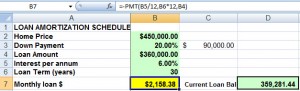

The following is an example of a mortgage loan payment calculation:

The function typed in to cell B7 in this illustration is =PMT(B5/12,B6*12,B4). B5 is the interest rate, which must be divided by 12 because it is an annual rate. B6 is the loan term, which must be multiplied by 12 for the 12 payments per year. B4 is the loan amount. In this example, there is no need to include Future Value or Type.

Note: There is also a PPMT function. PPMT returns the principal portion of a specific loan payment; where PMT returns the full, fixed payment for a loan.

Tags:

Excel,

PMT